For many entrepreneurs living outside the United States, America represents a huge market with opportunities to reach a diverse and potentially untapped customer and investor base.

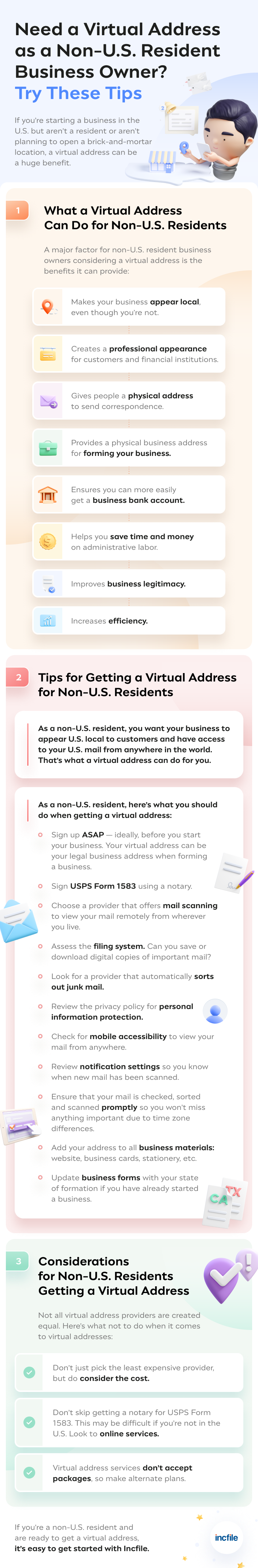

If you're establishing a business, such as an LLC, in the U.S. as a non-resident, you will need a physical business address in the state where your company is formed. If your company is online or doesn't have a brick-and-mortar location, a virtual address can be a great solution that provides business owners with a few extra benefits as well.

Benefits of a Virtual U.S. Business Address

Many businesses benefit from a physical location. A brick-and-mortar store or office can help add credibility and legitimacy, help showcase goods and services, meet your shipping and receiving needs and establish a presence in the community.

However, following this traditional route of “setting up shop” is no longer the only path for starting a business. For many living within the U.S., options can include mailbox and P.O Box services and coworking spaces. But when it comes to a non-resident conducting business, the best option can be a virtual address and mailbox.

Much like maintaining a storefront, a virtual address can come with a real street address and a location where your business receives all its mail and correspondence. A virtual address can be set up in each of the 50 states, and all you’ll need is just your device to view all of your incoming mail. Other benefits include:

Much like maintaining a storefront, a virtual address can come with a real street address and a location where your business receives all its mail and correspondence. A virtual address can be set up in each of the 50 states, and all you’ll need is just your device to view all of your incoming mail. Other benefits include:

- Your mail will be scanned and sent to you virtually to be viewed on your smartphone or computer.

- You can create a professional business appearance and provide your customers with a means of correspondence. (Like having an actual store, this can help build on the legitimacy of your business.)

- You can forward, save, delete, organize, prioritize, file and archive your correspondence.

- This type of service can help manage your time and add a level of efficiency when it comes to your business mail.

- Your junk mail will be weeded out.

- Your privacy is protected and you can communicate with vendors and clients securely.

- You can more easily get a business bank account in the U.S. with a U.S.-based mailing address.

- You can be anywhere in the world and still be able to conduct business, send out correspondence and stay on top of your incoming mail.

Can You Use a Virtual Mailbox for an LLC?

Yes. You can use a virtual mailbox address for any type of business, including an LLC. Your virtual mailbox address can be used as your business’s legal address, whether you’re a sole proprietorship, LLC, partnership or corporation.

Virtual Address vs. Registered Agent

A Registered Agent is required for all LLCs and corporations in all states. Having a third-party Registered Agent service for your business is a service worth having, especially as a non-resident business owner. It will help you manage your legal documents and keep you from making any costly blunders. It will also help provide a physical address for your filings and legal correspondence.

However, a Registered Agent cannot use a P.O. Box or virtual address and must be physically present at a street address to receive state and government correspondence. This type of service should be kept separate from your virtual mailbox.

If you are living abroad, a Registered Agent will help keep track of important legal notices, including tax information. One thing you cannot do, however, is cut corners and use your Registered Agent address as a virtual mailbox for your business. A Registered Agent's main role is to keep you in compliance with state filings and up to date with your paperwork — not to manage or deliver your customer orders or vendor communications.

Getting a Virtual Mailbox as a Non-U.S. Resident

Starting a business in the U.S. as a non-resident can require extra steps, such as obtaining a Visa, getting an EIN without a Social Security number and potentially paying extra income taxes. Getting a virtual address as a non-resident will follow the same steps that a U.S. citizen or resident will take. However, certain requirements, such as filling out and notarizing USPS Form 1583, may prove more difficult if you're not physically in the U.S.

This form allows an agency to receive your mail and must be filled out by you as the business owner in order to utilize a virtual mailbox. This form must be signed in the presence of a notary. Notaries can be found at banks and embassies. If you're unable to physically sign this form in front of a notary, look into online notary services and check with your chosen virtual address service to see if they accept this type of notary service.

As a non-resident, you will also want to confirm that your forms of identification are acceptable for your mailbox service and that you can make your monthly payment using your preferred method, such as a credit card, PayPal or money order.

Incfile's Virtual Address Service

Incfile provides a Virtual Address service that can help you execute control over the day-to-day correspondence of your business. Our service includes:

- Security and encryption protection of your correspondence.

- Digital mail scanning of all correspondence in a timely manner.

- Access through your web browser from anywhere in the world that has a connection to the internet.

- Email notifications every time your mail is scanned.

- Mobile compatibility that makes it easy to view correspondence on your desktop, laptop, smartphone or tablet.

Starting a business as a non-U.S. resident can be an exciting time, but one filled with challenges. Using a virtual address service can provide you with the flexibility you need to run your business in the location that makes the most sense for you.

Incfile's entire customer support team is fluent in both English and Spanish.