Operating a thriving ecommerce business? If so, you're part of a booming industry set to surpass $6 trillion (yep, that's "trillion," with a "T") in sales by 2023. Ecommerce has experienced tremendous growth in recent years, but the global pandemic in 2020 clinched the deal — online selling is the future of doing business.

Credit Cards for Ecommerce Business Owners: A Guide

As your online business grows, it's more important than ever to establish good business credit. And one of the best ways to do that is to find the right business credit card for ecommerce owners. Here, we take a look at some of the reasons you need a business credit card, what to look for, and our top picks to get you started.

Why Does Your Ecommerce Business Need a Credit Card?

Business credit can be a slippery slope, and it's one you have to tread carefully. However, applying for and using a business credit card — when done correctly — makes good financial sense. What are the benefits of holding a business credit card for your ecommerce business?

- It's a good step in keeping your personal and business finances separate, which is critical to operating a successful business.

- It lends credibility to your business and builds your reputation as an owner.

- It allows you to make quick financial decisions, even when cash flow is low.

- It gives you the flexibility to spend how and where you want, while racking up rewards that could benefit your business.

The Biggest Players in Ecommerce Business Credit

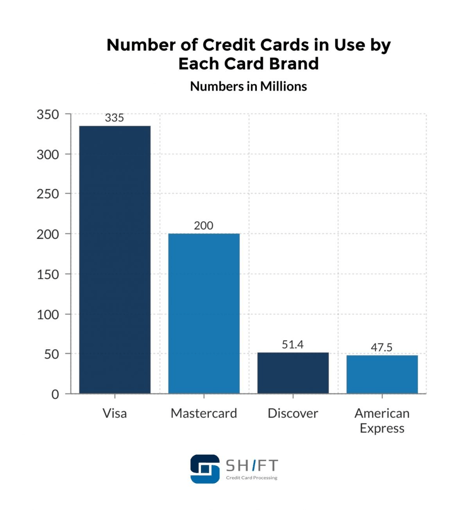

Visa and Mastercard are the top dogs in credit card usage across the country, especially amongst personal credit card users. But while American Express is at the bottom of the pack, statistically speaking, it is frequently upheld as one of the best options for business owners (more on that in a bit).

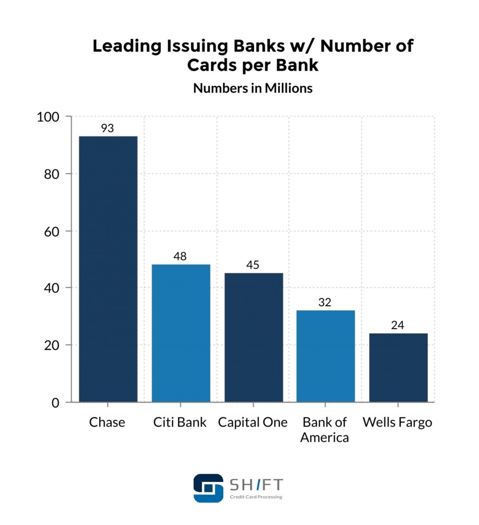

Outside of the four major names in business credit cards, banks also look to get a piece of the action. In this realm, Chase is the go-to option, not just for individuals, but for businesses as well.

How to Decide Which Credit Card Is Right for Your Ecommerce Business

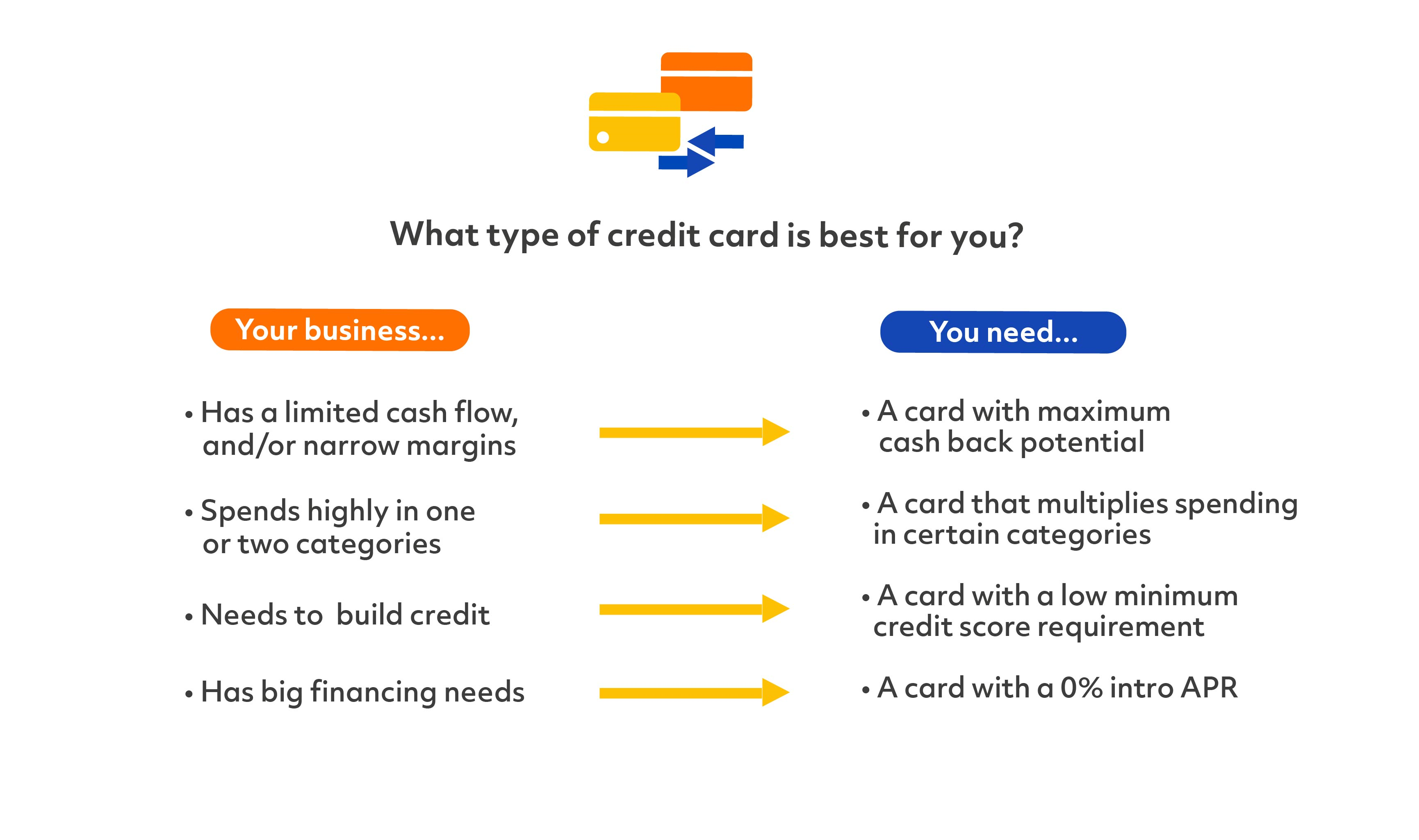

There are several key factors you want to look for when vetting business credit cards. As an ecommerce owner, your needs may be slightly different from those of other businesses, and you'll want to take that into account when doing your research. For ecommerce businesses, the top features and benefits to look for include:

- Large spending limits to cover your biggest purchases, like shipping/warehousing, marketing and website hosting and maintenance.

- Low interest rates or interest-free periods so you can incur the least amount of additional costs when purchasing products.

- Purchase protection in the event of a crisis, recession or personal setback.

- Rewards that can be earned and then used on business expenses unique to your ecommerce business.

- Low or no fees. Credit card fees can add up quickly, increasing your overall debt. Make sure your card has a fee you can manage, and pay it on time, every time.

Source: Referral Candy

Our Top Ecommerce Business Credit Card Picks

Best for Custom Cash Back Rewards: Bank of America Cash Rewards Card

No annual fee, plus a $200 signup bonus (when you spend $1,000 in the first 90 days) is just the start of the rewards you'll benefit from with this card. You'll have the chance to pick your reward and earn 3 percent cash back on the category you choose, like travel or online purchases.

Best for Digital Nomads and Frequent Business Travelers: AmEx Business Platinum

While it comes with a high annual fee ($595), AmEx sets the standard in business credit cards, and it delivers on the perks. The platinum card rewards travelers with a high-earning points system and opportunities to rack up bonus points. It also gives business owners access to travel benefits like international lounges, travel insurance and trip cancellation. Plus, if you're a globetrotting business owner, you'll never incur foreign transaction fees when you use your platinum card.

Best for Amazon Sellers: AmEx Amazon Business Prime

You're already selling on Amazon, and you're likely to be buying there, too. This card rewards every purchase made on the platform with 5 percent cash back, and offers special signup bonuses to Prime members, including a $125 Amazon gift card. Best of all, there's no annual fee, opportunities for 90-day 0 percent APR and purchase protection up to $1,000 per account.

Best for Domestic-Only Businesses and Travelers: Chase Ink Business Cash Card

If you stick close to home and are looking for maximum cash back and rewards, this is the card for you. There's no annual fee, and you'll earn 5 percent cash back on your first $25,000 spent in select categories. Ramp up the rewards with another 2 percent cash back on the first $25,000 spent at gas stations and restaurants, and 1 percent on everything else for the life of the account. The Ink Business Cash card also comes with one of the best signup bonuses — $750 you can put straight back into your ecommerce business. There are international travel fees, so it's not the best choice for digital nomads or frequent business travelers, but the other perks significantly outweigh the downsides.

Best for Easy-to-Redeem Rewards: Discover It Business Card

Discover may not be the first choice for many business owners, but it offers easy reward-earning and redeeming that pushes it to the front of the pack. There's no annual fee, and you'll earn unlimited 1.5 percent cash back on every single purchase. Plus, in your first year, Discover will give you an unlimited cash back match, so the rewards can really pile up. And if you use Amazon to make purchases for your ecommerce business, you can link your Prime and Discover accounts, so you can automatically put your cash back rewards toward your purchases.

Best for Digital Startups: Brex Exclusive Card

Brex isn't for just any business owner. This card is designed exclusively to meet your ecommerce needs, but it comes with a caveat: you must agree that Brex will be your only corporate business card. If that works for you, you'll reap the benefits, like multiplied rewards across numerous categories, including recurring SaaS and software purchases. Brex also offers in-depth expense tracking, bill pay and spend controls to help you manage your business credit wisely.

A Final Word of Caution

No matter which business credit card you choose for your ecommerce business, it's important to understand how to properly manage your credit card debt so it doesn't become overwhelming (or worse, destructive). After more than a year of financial uncertainty, we know that a crisis can happen at any time, but being prepared and making smart decisions will put you ahead of the game, no matter what lies ahead.

The best credit card for your ecommerce business may take many forms, depending on your needs and finances. If you need some help comparing our top picks, check out our extensive report on the best credit card options for 2021.