If you are planning on forming a Limited Liability Company (LLC) in Texas, it’s important to have an LLC Operating Agreement. The agreement will include detailed information about the ownership of the LLC and will help define how the business is managed, the distribution of profits, the roles of the LLC members and how key business decisions are made.

An LLC Operating Agreement is a legally binding document. It helps ensure that the terms of the contract are supported by its members. It also protects the status of the business by reaffirming that it is run as a Limited Liability Company. Not having an agreement in place at the launch of an LLC can prove to be a big mistake and can lead to avoidable conflicts and issues, especially when it comes to the business’s management, operations and finances.

What’s in a Texas Operating Agreement?

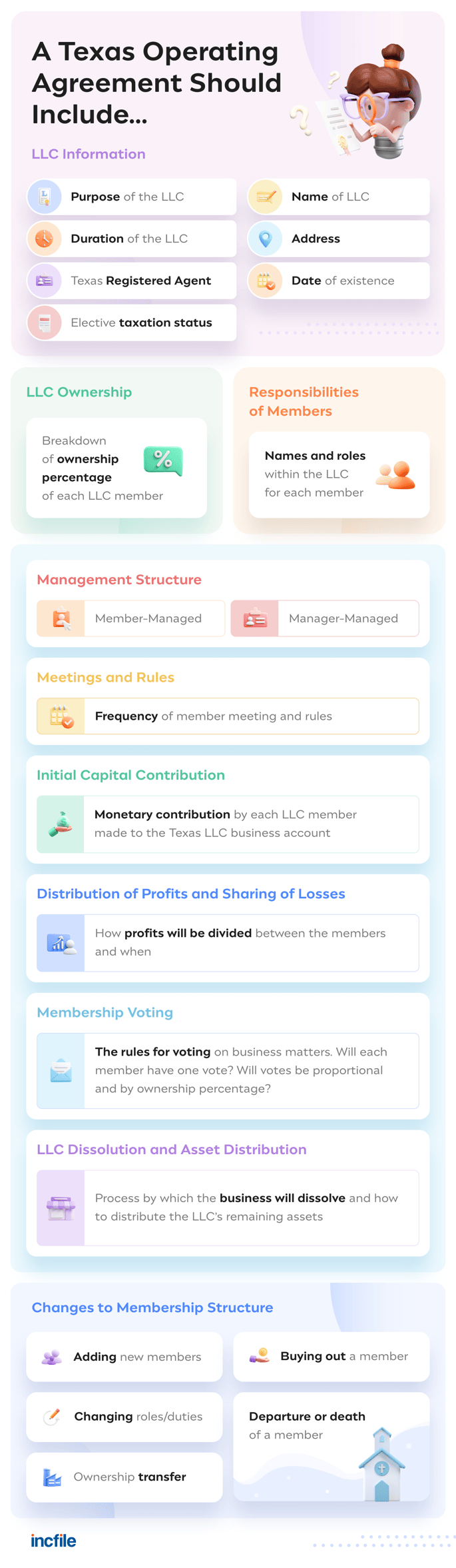

Overall, a Texas Operating Agreement will cover information on:

- Company information: name of the LLC, date of formation, Texas business address, etc.

- Capital contributions: from members or other contributors

- Profits, losses and distributions: how these items are allocated among members

- Management: member roles and responsibilities and company records

- Membership compensation: how members are paid

- Bookkeeping: accounting method used, financial records, etc.

- Adding or removing members: the process of removing and adding members

- Dissolution: when the LLC can be dissolved and how debts and assets will be handled

For even more details on the sections, see our guide on what's included in an Operating Agreement.

Does Texas Require Operating Agreements?

Although it's not required by law in Texas, Operating Agreements are important for an LLC and help ascertain the rules and guidelines to help run a business. The protocols established in the agreement are meant to clearly define important processes and avoid any potential confusion or unintended problems that may arise down the road when it comes to running the business and making decisions.

An Operating Agreement is also an important document if the business is challenged and faces litigation. Having this formal agreement also reinforces the corporation’s “limited liability” status by protecting its members and their personal assets.

Does the Operating Agreement Need to Be Filed?

A Texas LLC Agreement does not need to be submitted or filed with a specific government agency, such as the Texas Secretary of State. For the document to be legitimate, however, it must be signed by all the LLC members. The agreement will then be considered formalized and legally binding to all the terms and conditions of the agreement.

Your Texas LLC Operating Agreement is a key founding document for your business. Although changes can be made through an amendment process, it’s best to get everything on paper and approved by the members with the initial contract.

5 Common Mistakes to Avoid When Creating an Operating Agreement

1. Rushing Through the Process

Lots of decisions will need to be made when putting together an operating agreement, and depending on the size of the LLC and the number of LLC members, there will be many opinions and viewpoints to consider. Rather than rush through the process and risk overlooking key sections and clauses, members should take the time and work through sticking points. Revisiting undecided matters may prove to be a larger issue when it comes to efficiently running the business.

2. Using Ambiguous Language

Clarity in the agreement will avoid any misunderstanding and will avoid setting up potential issues that may arise as a result of “interpreting” what was intended in the agreement.

3. Neglecting to Have All the LLC Members Sign the Agreement

In the case of your Texas Operating Agreement, all the LLC members will need to sign off on the contract. There are no abstentions or missing signatures. These are the rules of the business that should be supported by all the members of the organization.

4. Not Having a Professional Review the Agreement

It’s a good idea to have an experienced attorney review the agreement in case any important information is missing. This will save you from any oversights that may affect the smooth operation of the LLC.

5. Filing It Away and Not Amending

Although the Operating Agreement functions as the blueprint of the business, that doesn’t mean that changes cannot be made to the contract that will help address some upcoming or unforeseeable need. Staying up to date with the way the business is structured and managed is critical to any business. If and when changes are made to the LLC’s operation, process, finances or any of the clauses from the original contacts, these changes should be reflected in the agreement through amendments.

Main Types of LLC Operating Agreements

If you’re wondering whether an operating agreement is required for a single-member LLC in Texas, this section will help answer your question, so read on.

There are three main types of LLC Operating Agreements used in Texas. These consist of (1) Single-Member, (2) Member-Managed and (3) Manager-Managed Agreement.

Single-Member Operating Agreement

This would be the choice for a sole proprietor who's planning to form an LLC as a single member. The main benefit in having a single-member agreement is the simplicity it offers. For one, there will be no disagreements with the other members because you're the only one!

Member-Managed Operating Agreement

Unlike the single-member Operating Agreement, all the members that are part of a multi-member LLC will need to comply with the terms and clauses of the contract. They will need to agree on everything from the distribution of profits and sharing of liability to the meeting frequency and the process of adding or removing members. Each member may also serve a role or function in the managing of a multi-member LLC. And don't forget...the agreement is not binding until all the members sign the finalized Operating Agreement.

Manager-Managed Operating Agreement

This type of agreement may be the preferred option if LLC members want to play a more passive ("silent") or hands-off role in the management of the business. It also can depend on the level of experience of the LLC members when it comes to running a business. Under this structure, the management role is left to professionals with more experience.

Write a Customized Texas Operating Agreement for Your LLC

Are you ready to take the next step? We are here to help you put together an Operating Agreement for your Texas LLC. Our business formation specialists have assisted thousands of business owners and entrepreneurs looking to start an LLC in the Lone Star State.