Starting and running a prosperous small business requires careful financial planning. That's where a small business financial plan comes in: With one in your toolbox, you'll be better equipped to make informed financial decisions and achieve your goals.

As luck would have it, creating your own financial plan isn't as challenging as you may think. In fact, you're only six steps away from completing yours, so let's start at the beginning.

What Is a Small Business Financial Plan?

A small business financial plan is a comprehensive document outlining your business's financial goals, strategies, and projections. A financial plan for a small business helps you make informed decisions about your finances, allocate resources effectively, and assess the viability of your business concept.

If you carefully craft your financial plan, you'll be able to:

- secure funding from investors or lenders;

- accurately monitor your business's financial health; and

- make necessary adjustments to your budget and spending.

Key Elements of a Business Financial Plan

Just as with standard business plans, no two financial plans are exactly the same. But in general, all financial plans should contain the following key elements:

Business Financial Goals

Begin by clearly defining your short-term and long-term financial goals. These may include objectives such as:

- increasing revenue;

- acquiring more clients;

- improving profit margins;

- reducing debt;

- expanding operations; or

- entering new markets.

Clear and articulate goals will provide a foundation for your financial plan and direction for your future decisions.

To ensure your goals are effective and helpful, follow the SMART framework:

- Specific: Steer clear of nebulous goals and strive to be as specific as possible.

- Measurable: You should be able to measure your progress towards meeting each goal with clear metrics.

- Achievable: If you set unachievable goals, you'll only be setting yourself up for failure. So, only set objectives you know are within the realm of possibility.

- Relevant: Each goal should be directly related to your business and its activities.

- Time-based: Give yourself a target deadline for each goal.

Current Financials and Assets

You can't make a plan for the future if you don't know where you stand today. So, you'll need to take the time to assess your current financial position. You can do so by examining your current financial statements, as well as taking stock of your assets, liabilities, revenue, and expenses.

This analysis will provide you with insights into your business's financial strengths and weaknesses, and it will also help you identify opportunities for improvement.

To stay organized, record the results of your analysis in an orderly fashion that makes sense for your business. This could mean creating spreadsheets, lists, graphs, written explanations, or a combination — whatever works best for you.

Financial Timeline

Determine the time frame for your financial plan. This can range from a year to five years or more, depending on the nature of your business and your long-term objectives.

Establishing a timeline will allow you to set specific milestones, track your progress over time, and get motivated to tackle your tasks in a timely manner.

How to Create a Small Business Financial Plan

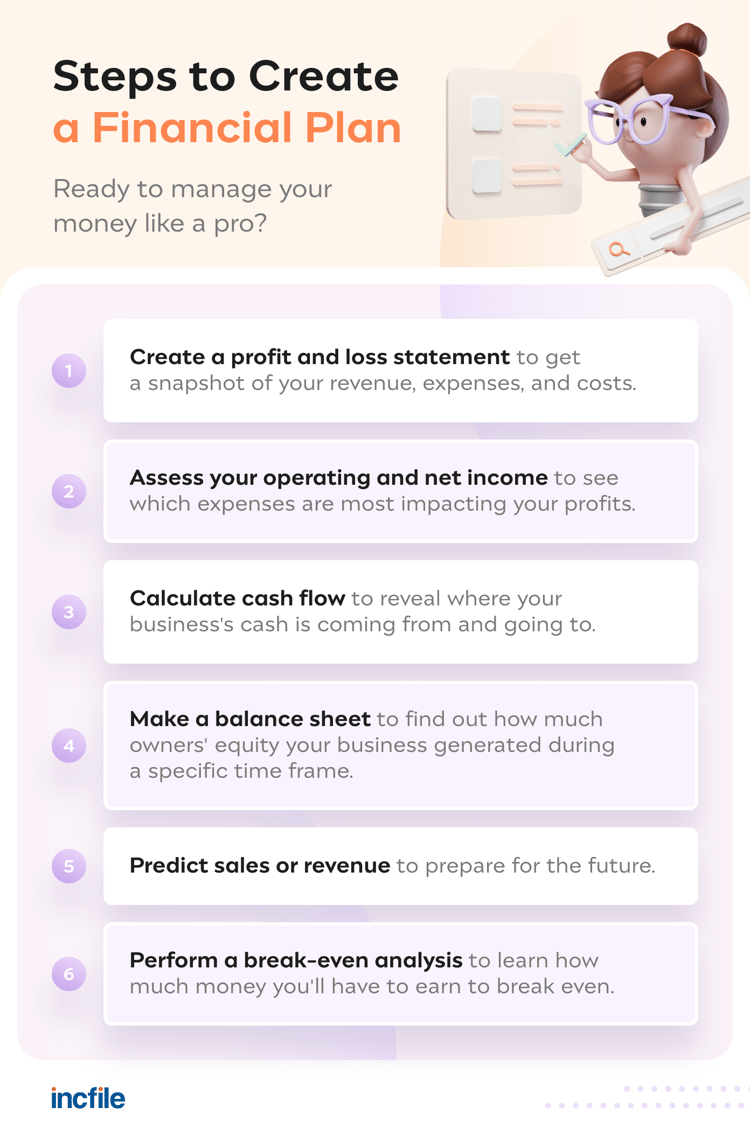

Use these six steps to create a comprehensive financial plan for your small business:

1. Create a Profit and Loss Statement

The name profit and loss statement (or P&L for short) may sound complicated, but it's actually quite simple. Donna Tang, budgeting and finance expert at CreditDonkey, explains that "you can determine the profitability of your business by checking the net profit margin. Use a simple formula to calculate net profit: revenue – expenses = profit."

Stay organized by labeling each of your business expenses as well as the cost of goods sold (COGS). If you've yet to start your business, be sure to account for startup costs, too.

Want to delve a little deeper? Tang says you can analyze whether your revenue is appreciating or depreciating over time. You can also look at the number of sales earned through a specific period of time to glean insights about your customer acquisition and retention.

2. Determine Your Operating and Net Income

Calculate your operating income by subtracting your operating expenses from your gross profit. Operating income reflects your business's profits after deducting operating expenses but before considering interest, taxes, and other non-operating costs.

Next, determine your net income by subtracting taxes, interest payments, and other non-operating expenses from your operating income. This will give you a clear picture of your business's overall profitability.

After calculating both your operating and net income, you'll know exactly which expenses are affecting your profits the most.

3. Calculate Your Cash Flow Statement

A cash flow statement tracks where your business's money is coming from and where it's going over a certain time period. By creating a cash flow statement, you'll be able to better understand your business's liquidity, identify cash shortages or surpluses, and make adjustments accordingly.

To calculate your cash flow statement, do the following:

- Decide on a reporting period. For example, you could choose to analyze the most recent quarter.

- Determine your starting balance. This is the amount of cash your business had at the beginning of the reporting period.

- Count cash earned from operating activities. Remember to subtract the amount of money you spend on operating activities, too.

- Count cash earned from investments. This could mean any money you earn from selling equipment or property, for instance.

- Calculate cash flow from financing activities. Include the cash you've earned and spent on repaying loans, raising money from investors, and similar activities.

- Get your ending balance based on all the calculations you've made thus far.

Accurately calculating your cash flow is also important because it can help you find opportunities to set aside more emergency funds. Ruth King, a successful entrepreneur known as the “Profit and Wealth Guru," says that maintaining a good cash reserve is crucial to a business's financial health.

King says the minimum amount of cash you have saved for emergencies should be “a company’s payroll in the busiest month of its year times three, plus the overhead in the busiest month of the year times six."

4. Make Your Balance Sheet

A balance sheet provides a snapshot of your business's financial position at a particular point in time. It includes the business's assets, liabilities, and equity.

Balance sheets are generally created using this formula:

liabilities + owners' equity = assets

When creating yours, remember that assets and liabilities should be organized as follows:

- Assets include cash, inventory, accounts receivable, and so on, as well as land, patents, trademarks, equipment, and other long-term investments.

- Liabilities include all the money your business owes. For example, your liabilities might take the form of rent payments, debt financing, payroll owed, and the like.

After subtracting your business's liabilities from its assets, you'll be left with the total owners' equity. In other words, the share of the business that its owner(s) can claim.

5. Project Sales or Revenue

Forecasting your sales or revenue is an essential step in planning your financial future. When doing so, consider historical data, market trends, industry benchmarks, and your marketing and sales strategies.

Remember to be realistic and take into account any risks or challenges you may encounter in the near future.

6. Complete a Break-Even Analysis

A break-even analysis determines the point at which your business's revenue is equal to its expenses, resulting in neither profit nor loss. In other words, this analysis allows you to understand how much revenue you need to earn to cover your fixed and variable costs. (Tip: Fixed costs are those that are the same every month or year, such as rent. Variable costs are expenses that can vary from payment to payment, such as utility bills.)

By calculating your break-even point, you can set more realistic sales targets and understand the impact of price changes or cost reductions on your business's overall profits.

To complete a break-even analysis, simply calculate all your fixed and variable costs over a certain period of time. This number is the same amount you'll have to earn to break even.

What to Do After You Have Your Financial Plan

Once you've created a financial plan for your small business, it's crucial to regularly review and update it to reflect changes in both your business and the external environment. Even if you haven't formed your business yet, a financial plan can help you hit the ground running and set your new company up for success.

Whether you're considering making a large investment, adopting new cost-saving measures, applying for a small business loan, or making other financial changes, you can use your financial plan to see exactly how those changes will affect your business, and you can make smarter decisions as a result.

On a more exciting note, financial planning will also increase your chances of securing funding from investors or lenders. Similarly, if you're looking to sell your business, a detailed financial plan can make it much easier to do so.

Need help getting your finances organized and under control? Our Accounting and Bookkeeping service is here to assist. We'll help you with taxes, compliance, bookkeeping, reporting, and more. That way, you can focus on making your business thrive.

.png)