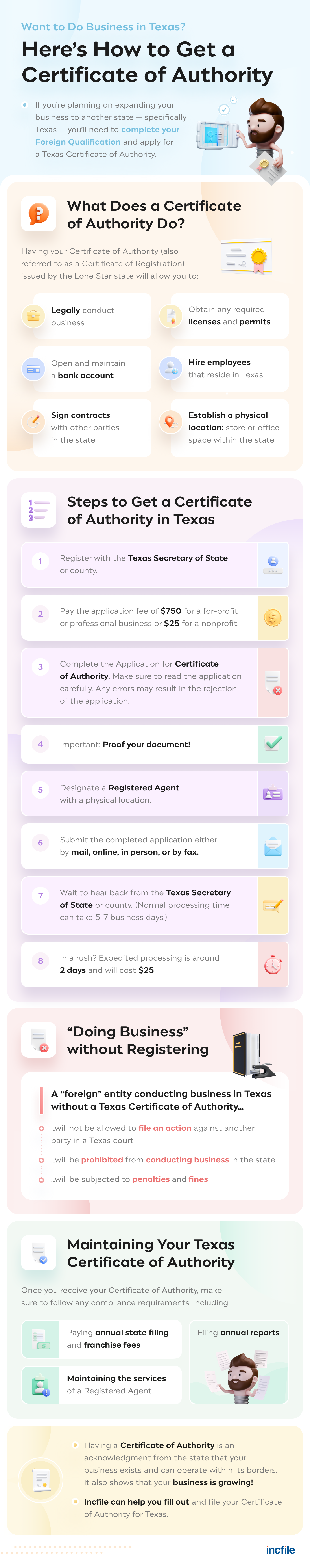

If you're planning on growing your business beyond your home state, one of the first things you'll need before you can transact any business beyond your borders is your Foreign Qualification by applying for a Certificate of Authority.

What is a Certificate of Authority for? It allows an out-of-state business to work with vendors, suppliers and banks; lease or rent property; and obtain the necessary licenses and permits necessary to conduct business.

Is a Certificate of Authority the same as a tax ID? No, a Texas Certificate of Authority gives you authorization to do business in Texas, while a tax ID is issued by the federal government to identify a business and calculate quarterly or annual tax obligations.

If the state you're eyeing for your company's expansion is the Lone Star State, then you'll need to submit the application with the Texas Secretary of State and pay a $750 fee.

How to Get a Certificate of Authority in Texas

The process of getting your Certificate of Authority in Texas is straightforward and can open up new business opportunities and growth. Here's what you need to know.

- Register with the Texas Secretary of State or county.

- Pay the application fee of $750 for a for-profit or professional business or $25 for a nonprofit.

- Complete the Application for Certificate of Authority. Make sure to read the application carefully. Any errors may result in the rejection of the application.

- Important: Proof your document!

- Designate a Registered Agent with a physical location.

- Submit the completed application either by mail, online, in person, or by fax.

- Wait to hear back from the Texas Secretary of State or county. (Normal processing time can take 5-7 business days.)

- In a rush? Expedited processing is around 2 days and will cost $25.

Filing Your Certificate of Authority in Texas

If you’re considering doing business in Texas and establishing your LLC, corporation, or Series LLC in the Lone Star State, the first step is to apply for and receive your Texas Certificate of Authority. Incfile can complete your Foreign Qualification requirements and allow you to focus on your company’s growth plans.