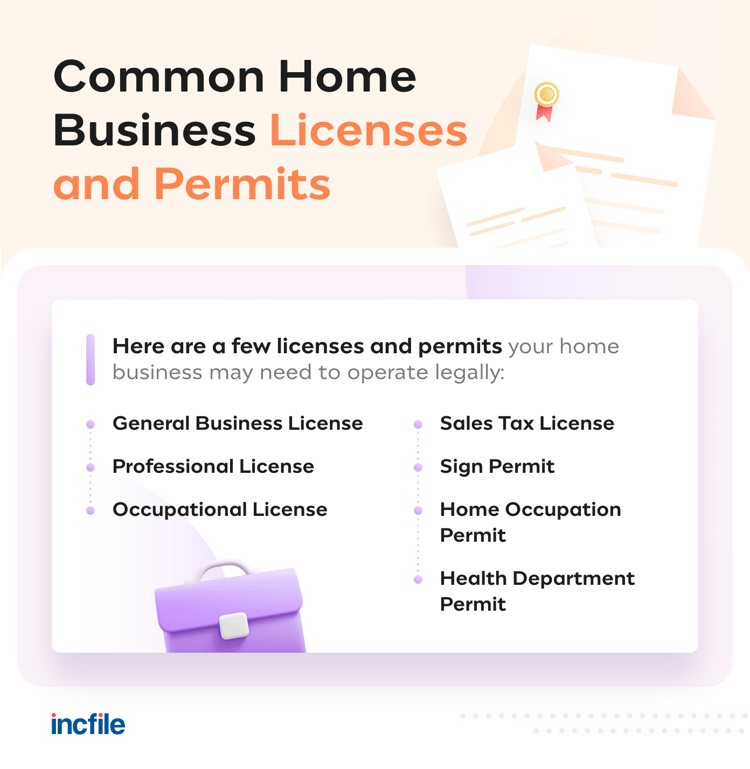

If you plan on joining the ranks of home-based business entrepreneurs, it’s important to do it right. For your business to operate legally, you’ll need to have all the necessary licenses and permits. Without them, the repercussions could include fines and penalties, or your company could be shut down completely. So whether your home-based business is a side gig or a full-time operation, let's determine which home business licenses and permits your company needs.

What Licenses Does My Home-Based Business Need?

The type of business license you’ll need depends on what type of business you're running. Here are some common business licenses you may need for your home-based company:

General Business License

Most businesses need a business license to operate legally and be recognized by the government. In addition to registering your business, a business license will also allow you to open a bank account or apply for a loan. Acquiring a business license is a fairly simple process that can be done online. The fee for a general business license will depend on the city or state where the business operates. The fee that will need to be paid upon applying can range from $50 to a couple of hundred dollars.

Professional License

Have you ever noticed signs posted outside of homes displaying services for a lawyer, accountant, or even a foot doctor (aka podiatrist)? These professionals have opted to work out of their homes rather than from an office building or medical clinic. But to do so, they needed to acquire a license specific to their professions. A professional license reinforces that a business is operating legally and has the proper training and qualifications to provide service.

Many workers require professional licenses in order to practice their trade or professions. Some industries requiring professional licensing and certification include the following:

- Medicine

- Engineering

- Architecture

- Law

- Accounting

- Real Estate

- Insurance

- Tax Services

Occupational License

Businesses that sell a certain type of good or service may also require a specific license to conduct business. The license may need to be issued by the federal or state government.

Goods and services requiring the issuance of a special license include the following:

- Alcohol

- Tobacco

- Firearms

- Pharmaceuticals

- Investment Services

- Food

- Media

- Medical Equipment

In many states, you’ll need to show that you have your specific home occupation permit or professional license before you can acquire your general business license.

Sales Tax License

In most states and municipalities, businesses selling products or providing services are required to apply for a sale tax license. This allows them to charge a sales tax and submit the collected funds to the city or state. States that do not require a sales tax include Alaska, Delaware, Oregon, New Hampshire, and Montana. These states may not impose a sales tax, but municipalities within these states may have their own tax rate. Make sure you know the tax rate in your city or state before applying for your business license.

Permits for Your Home Office

In addition to acquiring the proper licenses, many businesses also require permits. At this point, you may be wondering: What’s the difference between a license and a permit? Licenses tend to be long-term and permanent unless revoked. For example, a licensed healthcare professional can have their license revoked if they harm a patient or break the law. (Note: Some licenses do require recertification after a number of years.)

Permits, on the other hand, are temporary and have an expiration date, and many include the option of renewal. Permits are focused on a specific task or activity. Common home business permits include the following:

Sign Permit

A sign permit allows you to advertise your business by posting a sign where you live. Cities and towns may have specific regulations regarding the size of your sign, whether it can be illuminated, and even where it can be placed.

In New York City, for example, signs posted within residential areas can only extend by 12 inches, and their height cannot be higher than 12 inches above the ceiling of the ground floor. There’s even a commonsense regulation on the lettering and coloring of signs in NYC which states lettering should be bold-type and properly spaced to provide legibility.

Home Occupation Permit

In order to acquire this permit, you’ll need to prove your business is owned and operated by the resident of your home. This permit also sets limitations on the number of people who can work for the business while not being in the residence.

To acquire a home occupation permit, you’ll need to contact the local Homeowner Association (HOA). You may also need to reach out to the city or county building department, fire department, or zoning administrator. Depending on the type of business you run, there may be restrictions to look out for within your residential zone.

Health Department Permit

Home-based businesses that cook, store, or handle food in any way will need to have their health department permit. This tends to be an annual certificate that shows your business has been inspected and all the necessary steps and precautions have been followed. Depending on your business's activity, you may also require a fire permit.

How to Get a Business License

Let’s assume you've completed all your business formation requirements and have registered your business. You have secured your business name, registered your business entity with the state, and acquired an Employer Identification Number (EIN). Now, you’re ready for your business license. Here are the steps to acquiring your business license:

1. Determine the Licenses Needed

Figure out what the requirements are for your specific home business, as well as any additional licenses or permits that may be required. Incfile's Business License Search Tool will show you the business licenses you need for your state and industry. You can also visit your state's Secretary of State website for more info.

2. Research Zoning Requirements

Make sure that there are no zoning restrictions that could leave your home business in violation of local ordinances or regulations. Failure to do so will subject your business to penalties, fines, or even the risk of a shutdown.

To learn about any potential zoning restrictions, contact your city or county's municipal planning or building department.

3. Contact Your Local Administration Office

Visit your state or county general administration office. For most locations, this can be accomplished through an online search. Some cities and counties may even require an in-person visit to the local business administration office.

4. Fill Out an Application

In order to obtain a home business license, an application must be completed either online or in person. Some of the required information may include the following:

- Business name and address

- EIN or Social Security Number

- Description of the business

- Owner's contact information

- Employee information

- Hours of operation

- Professional licenses and types

5. Pay the Application Fee

Fees and charges due upon submitting your application depend on the city and county where you file and the type of business you plan to start. A home-business application may include a regulatory fee as well as a charge for the number of employees or the number of vehicles associated with the business.

Some common fees can include the following:

- Operating as a second-hand dealer

- Handling hazardous material

- Inspection fees

- Occupation-specific fees: spa, daycare, beauty salon, barber shop, etc.

6. Double-Check Your Application

Make sure all the information is correct and the application is complete. Common mistakes that may hold up your application may include the following:

- Typos, including misspelled names

- Incorrect address or phone number

- Unclear description summarizing the purpose of the business

- Missing payment

Additional Restrictions

As noted above, it’s important to do your homework and uncover any potential restrictions on the acquisition of your home business license. Some examples of these restrictions may include the following:

- Limitations on the number of employees that can work at the location or people that can occupy the building at one time

- Parking restrictions, including the number and types of vehicles that can park in the neighborhood

- Zoning rules

- Environmental restrictions

- Limits to any renovations or remodeling to the outside of the home

Benefits of Keeping Your Home Business in Good Standing

Keeping your business in good standing allows you to keep up with tax payments, have good relations with your customers or clients, and stay compliant with state and community regulations.

If you fail to keep your business in good standing, you could lose your business’s Certificate of Good Standing, which could potentially result in the following:

- Difficulty when applying for licenses or renewing permits

- Potential fines and fees from the state for being non-compliant

- Loss of access to the court system

- Inability to raise money from investors or gain access to business loans or lines of credit

- Dissolution of your business

Home Business FAQs

Can I Start a Business Without Registering It?

If you choose to start your home business without registering it, you'll be considered a sole proprietorship and won't have the protections afforded to a registered business entity such as a Limited Liability Corporation (LLC). You will also need to use your Social Security and legal name for your business and meet any tax requirements from the state or local government. Despite not having to register your business as a sole proprietor, you still need to get any required business licenses.

Can I Open a Business Without a Business Permit?

You cannot legally operate without all the required licenses and permits for your business. Failing to file for the appropriate permit for your business can result in penalties, fines, and even lawsuits, all of which are consequences that will affect your business's bottom line and reputation.

Do I Need to Register My Small Business With the IRS?

The money earned through your business will need to be reported to the IRS. By obtaining an EIN, you are formally registering your business with the IRS. EINs are required for several types of businesses, including LLCs that have one or more employees, as well as corporations and partnerships. If you're working as a sole proprietor, your Social Security number will be used instead. Income earned as a sole proprietor will need to be reported in tax filings.

Start Your Home Business With Incfile

Many of today’s major corporations started out of a home, basement, or garage — think of Apple, Amazon, and even the Walt Disney Company. If you’re ready to start your dream of owning and operating a business in your home, our team of professionals can assist.

Our Business License and Research Package will take away the guesswork and help you acquire all the licenses and permits you need to get started.