An Employer Identification Number (EIN) is a way for businesses to identify themselves to the IRS and state agencies for tax purposes. You might wonder if you need a new EIN if you move from being a sole proprietor to running a Limited Liability Company (LLC).

The answer is yes — if you have an EIN for your sole proprietorship and you form an LLC, we recommend that you should get a new EIN. The IRS specifically states that a sole proprietor transitioning to an LLC needs a new EIN under the following circumstances:

“If you have an existing EIN as a sole proprietor and become a sole owner of a Limited Liability Company (LLC) that has employees or needs to file an excise or pension plan tax return, you need to get a separate EIN for the LLC to file employment taxes.”

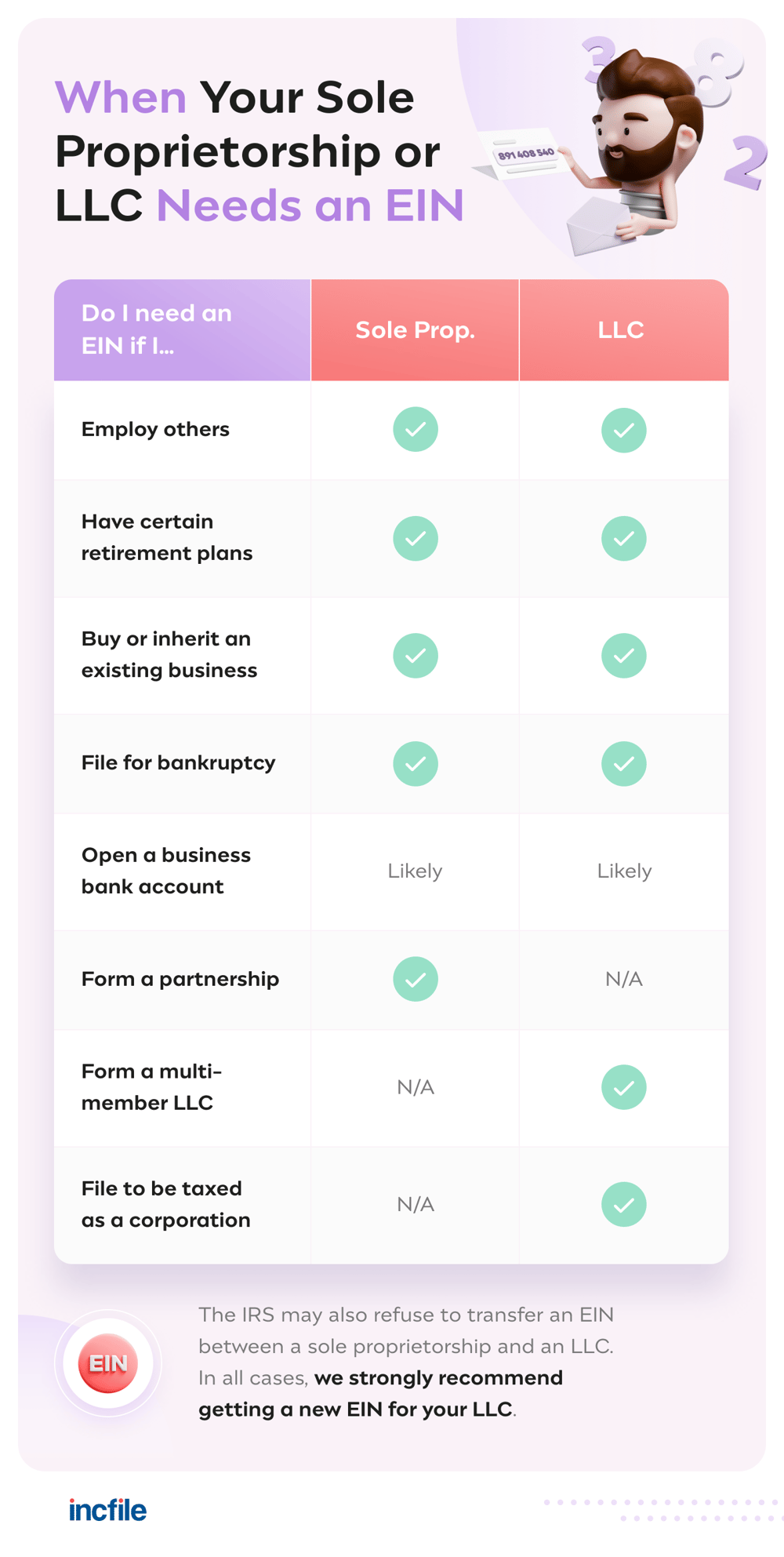

The IRS also says that sole proprietors need a new EIN if any of the following are true:

- You are subject to a bankruptcy proceeding.

- You take in partners and operate as a partnership.

- You purchase or inherit an existing business that you operate as a sole proprietorship.

- You incorporate.

Although that last point, incorporation, is associated more with S Corporations and C Corporations, it’s helpful if you apply it to forming an LLC as well. Getting a new EIN helps you avoid any complications with the IRS. It has also been said that the IRS will refuse to transition an existing EIN between a sole proprietorship and an LLC.

When Does a Sole Proprietorship Need an EIN?

Sole proprietors always need an EIN if you:

- Employ others, as an EIN is a legal requirement for hiring employees

- Have certain types of retirement plans

- File an excise or pension plan tax return

- Buy or inherit an existing business

- Form a partnership

- File for bankruptcy

These requirements also apply to LLCs.

Can You Have a Sole Proprietorship Without an EIN?

Yes, if you’re not employing anyone or you don’t meet any of the requirements in the previous answer, then you don’t need an EIN for your sole proprietorship. In those cases, you would use your Social Security Number (SSN) instead of your EIN when filing taxes.

When Does an LLC Need an EIN?

LLCs need an EIN for the same reasons as sole proprietors, which we’ve included again below. Your LLC needs an EIN if they:

- Employ others

- Have certain types of retirement plans

- File an excise or pension plan tax return

- Buy or inherit an existing business

- Form a partnership

- File for bankruptcy

Additionally, LLCs also need an EIN if they:

- Are a multi-member LLC with more than one member or manager

- Are taxed as an S or C Corporation

Can You Have an LLC Without an EIN?

If you’re not employing anyone or you don’t meet any of the requirements in the previous information on sole proprietorships and LLCs, then you don’t need an EIN for your LLC. In those cases, you would use your SSN instead of your EIN when filing taxes.

Here’s our in-depth guide to when LLCs do and don’t need an EIN.

Does a Sole Proprietor or LLC Need an EIN for Other Reasons?

Both sole proprietors and LLCs may require an EIN if they want to open a business bank account. That’s because some banks need an EIN as part of the application process to open an account. While sole proprietors are not legally required to have a business bank account, it’s often a good idea to do so, as it can make bookkeeping, reconciliation, accounting and taxes easier.

LLCs are legally required to have a business bank account to keep personal and business assets separate. This separation of assets is an important part of liability protection and can protect your personal assets if your LLC gets into trouble. It’s one of the reasons we always recommend an EIN for your LLC, whether you legally need one or not.

How Do I Get an EIN as a Sole Proprietor?

You have a couple of options on how to get an EIN as a sole proprietor:

- You can get an EIN yourself, directly from the IRS. Here’s our guide on exactly what you need to do.

- You can use Incfile’s EIN service and we’ll get an EIN on your behalf. Our service is fast, easy and hassle-free.

How Do I Get an EIN as an LLC?

Whether you’re forming an LLC or you’re already established, there are several ways you can get a new EIN.

- You can get an EIN yourself through the online IRS system.

- If you form an LLC through Incfile using our Gold or Platinum packages, we’ll get an EIN for you automatically.

- You can also use our EIN service and we’ll get an EIN on your behalf.

Do I Need Different EINs If I am a Sole Proprietor and Run an LLC?

Yes, we recommend having a separate EIN for each business entity that you have. This helps to keep everything straight with the IRS and anywhere else that you’re filing taxes. You can get an EIN using the steps we covered in previous answers. We have a helpful guide to obtaining multiple EINs.

Does my EIN Carry Over If I Convert from a Sole Proprietor to an LLC?

It’s not immediately clear from the IRS if they will allow you to transition an EIN between different types of businesses, but we’ve heard that they typically refuse to do so. In any case, we would recommend getting a different EIN for your new business entity, either using Incfile’s service or getting one for yourself.

I Need an EIN for My LLC, What’s the Next Step?

If you’re forming your LLC through Incfile, and you choose our Gold or Platinum packages, then we’ll get you an EIN as part of forming your company. If you’re using our regular package, or you already have an LLC, then our EIN service is perfect for you.